Applied statistics in business and economics involves the practical application of data analysis to guide decision-making․ It empowers organizations to interpret data, identify trends, and make informed strategic choices․ Applied statistics is essential for solving real-world problems, optimizing operations, and predicting future outcomes in both business and economic contexts․

1․1․ Definition and Scope of Applied Statistics

Applied statistics is the practical application of statistical methods to solve real-world problems in business and economics; It involves collecting, organizing, analyzing, and interpreting data to inform decision-making․ The scope includes descriptive statistics, probability, hypothesis testing, and regression analysis․ These tools enable organizations to identify trends, predict outcomes, and optimize strategies, making it a cornerstone of data-driven decision-making in modern industries․

1․2․ Importance of Statistics in Business and Economic Decision-Making

Statistics is crucial for making informed decisions in business and economics․ It enables organizations to analyze data, identify trends, and forecast future outcomes, reducing uncertainty․ Statistical tools help in optimizing resource allocation, risk management, and process improvement․ By providing insights, statistics empowers businesses to make data-driven decisions, ensuring efficiency and competitiveness in dynamic markets․

Data Collection and Analysis in Business and Economics

Data collection and analysis are critical in business and economics for extracting insights․ They involve gathering, processing, and interpreting information to support informed decision-making․

2․1․ Sources of Data in Business and Economics

Sources of data in business and economics include government publications, industry reports, surveys, and internal company records․ These sources provide valuable insights for analysis, enabling organizations to make informed decisions and understand market trends․

2․2․ Methods of Data Collection

Common methods of data collection include surveys, experiments, observational studies, and census․ These techniques help gather relevant information for analysis, enabling businesses and economists to draw accurate conclusions and make informed decisions․ Each method has unique advantages, ensuring data reliability and relevance for specific applications in business and economic research․

Descriptive Statistics in Business Applications

Descriptive statistics involves summarizing and describing data to understand patterns and trends․ It uses measures of central tendency and dispersion to provide insights, aiding in informed decision-making in business․

3․1․ Measures of Central Tendency and Dispersion

Measures of central tendency, such as mean, median, and mode, summarize data by identifying central values․ Dispersion measures, like range, variance, and standard deviation, quantify data spread․ These metrics are essential in business for assessing performance, understanding customer behavior, and making data-driven decisions․ They provide insights into data distribution, helping organizations identify trends and variability in economic and business contexts effectively․

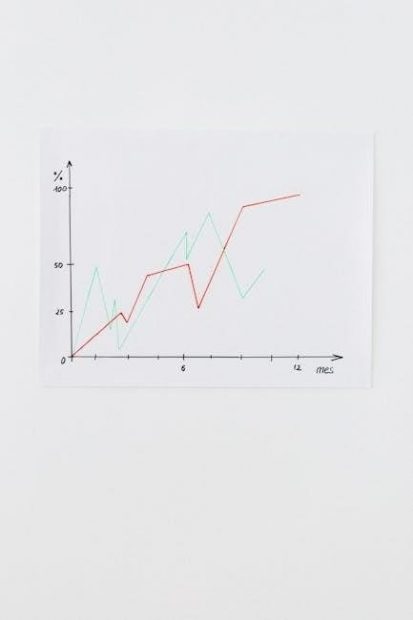

3․2․ Data Visualization Techniques

Data visualization transforms raw data into actionable insights through charts, graphs, and plots․ Tools like Excel, R, and Python enable creation of line graphs, bar charts, and heatmaps, helping businesses identify trends and patterns․ Visual representations simplify complex data, facilitating decision-making and communication․ Effective visualization enhances understanding of economic indicators, market trends, and customer behavior, driving informed strategies in business and economics․

Probability and Distributions in Economic Analysis

Probability and distributions are foundational in economic analysis, enabling modeling of uncertainty and decision-making under risk․ They provide tools to analyze variability and predict economic outcomes․

4․1․ Basic Concepts of Probability

Probability is a fundamental concept in applied statistics, measuring the likelihood of events․ It ranges from 0 (impossible) to 1 (certain)․ Key ideas include sample space, events, and probability rules․ In business and economics, probability aids in decision-making under uncertainty, such as forecasting demand or assessing risk․ Understanding probability distributions is crucial for modeling economic phenomena and predicting outcomes accurately․

4․2․ Common Probability Distributions in Economics

In economics, common probability distributions include the Normal distribution, used for modeling continuous variables like stock prices, and the Binomial distribution, for binary outcomes․ The Poisson distribution models rare events, while the Uniform distribution represents equal likelihood across a range․ These distributions help analyze and predict economic phenomena, such as market trends, consumer behavior, and risk assessment, enabling data-driven decisions in business and policy-making․

Hypothesis Testing in Business Decisions

Hypothesis testing is a statistical method used in business to validate assumptions and measure the effectiveness of strategies, enabling data-driven decision-making and informed outcomes․

5․1․ Formulating Hypotheses

Formulating hypotheses involves defining clear, testable statements to address business problems․ A null hypothesis represents the status quo, while an alternative hypothesis proposes a change․ This structured approach ensures statistical tests are focused, enabling precise analysis and actionable insights for informed decision-making in business and economics․

5․2․ Types of Hypothesis Tests

Common types of hypothesis tests include z-tests, t-tests, chi-square tests, ANOVA, and F-tests․ Each test is used for specific scenarios, such as comparing means, analyzing variances, or testing proportions․ These tools help businesses and economists validate assumptions, detect differences, and make data-driven decisions with confidence, ensuring robust conclusions in statistical analysis․

Regression Analysis in Economic Modeling

Regression analysis predicts economic trends using simple and multiple models, analyzing variable relationships and forecasting outcomes with tools like Excel, R, and Python for accurate insights․

6․1․ Simple and Multiple Regression Models

Simple regression analyzes the relationship between one independent and one dependent variable, while multiple regression involves multiple independent variables․ Both models predict outcomes, with multiple regression capturing complex interactions․ Tools like Excel, R, and Python facilitate these analyses, enabling businesses to forecast trends, optimize strategies, and make data-driven decisions efficiently in economic modeling and applied statistics contexts․

6․2․ Interpreting Regression Results

Interpreting regression results involves analyzing coefficients, R-squared, and residual analysis․ Coefficients show the impact of each variable on the outcome, while R-squared measures model fit․ Statistical significance is assessed using t-tests and p-values․ These insights help businesses understand relationships, predict outcomes, and refine models for better decision-making in economic and business contexts using applied statistics tools like Excel, R, and Python․

Time Series Analysis for Forecasting

Time series analysis examines sequential data to identify patterns and trends, enabling accurate forecasts․ It decomposes data into components like trend, seasonality, and noise to predict future outcomes effectively․

7․1․ Components of Time Series Data

Time series data consists of observations recorded at regular intervals, such as monthly sales or quarterly GDP․ It is composed of four key components: trend (long-term direction), seasonality (recurring patterns), cyclical patterns (longer-term fluctuations), and noise (random variability)․ Understanding these components is crucial for accurate forecasting and analysis in business and economic contexts․

7․2․ Techniques for Time Series Forecasting

Common techniques include moving averages, exponential smoothing, and ARIMA models․ These methods help identify patterns and predict future trends․ Naïve forecasting and regression analysis are also used․ Advanced approaches like machine learning and neural networks are increasingly applied․ Each technique varies in complexity and suitability, depending on data characteristics and forecasting goals․

Software Tools for Applied Statistics

Popular tools include Microsoft Excel, R, and Python, which offer robust statistical analysis capabilities․ SPSS and Stata are widely used for advanced modeling, while Tableau excels in data visualization․ These tools enable efficient data processing, hypothesis testing, and forecasting, supporting decision-making in business and economics․

8․1․ Microsoft Excel for Statistical Analysis

Microsoft Excel is a powerful tool for statistical analysis, offering built-in functions for descriptive statistics, regression, and hypothesis testing․ Its user-friendly interface allows easy data visualization through charts and graphs․ Excel’s Data Analysis add-in provides advanced features like ANOVA and t-tests․ Integrated exercises and concept videos in textbooks like Applied Statistics in Business and Economics highlight Excel’s versatility for business applications, making it a popular choice for both education and professional use․

8․2․ R and Python in Business and Economics

R and Python are increasingly popular in business and economics for their robust statistical capabilities․ Both languages offer extensive libraries like Pandas, NumPy, and Matplotlib for data manipulation and visualization․ They enable advanced analytics, machine learning, and big data handling, making them indispensable tools for modern business and economic analysis․ Their versatility and open-source nature foster innovation and efficiency in data-driven decision-making processes․

Case Studies in Business and Economics

Case studies demonstrate how businesses leverage statistical methods to solve problems, enhance decision-making, and drive growth․ Real-world examples highlight data-driven insights and practical solutions, showcasing the impact of applied statistics in achieving organizational success and economic efficiency․

9․1․ Real-World Applications of Statistical Methods

Statistical methods are widely applied in business and economics to solve practical problems․ Techniques like regression analysis, hypothesis testing, and forecasting are used to predict market trends, analyze customer behavior, and optimize operations․ Businesses employ these methods to make data-driven decisions, uncover insights, and improve efficiency․ Real-world examples include demand forecasting, risk assessment, and resource allocation, showcasing the tangible impact of applied statistics․

9․2․ Success Stories in Data-Driven Decision-Making

Companies like Walmart and Amazon exemplify how applied statistics drives success․ Walmart leverages big data to optimize supply chains, while Amazon uses machine learning for demand forecasting․ These firms demonstrate how statistical insights can enhance profitability, improve operational efficiency, and deliver personalized customer experiences․ Such success stories highlight the transformative power of data-driven decision-making in modern business and economics․

Emerging Trends in Applied Statistics

Emerging trends in applied statistics include big data analytics, AI integration, and predictive modeling․ These advancements enable businesses to make smarter, data-driven decisions efficiently and accurately․

10․1․ Big Data and Business Analytics

Big data and business analytics are revolutionizing decision-making by leveraging vast datasets․ Advanced tools like Excel, R, and Python enable businesses to analyze and interpret complex data․ These technologies facilitate predictive analytics, market trend identification, and optimized resource allocation․ By integrating big data, companies gain competitive advantages, enhance operational efficiency, and drive innovation in ever-evolving markets․

10․2․ Artificial Intelligence in Economic Modeling

Artificial intelligence (AI) is transforming economic modeling by enabling advanced data analysis and predictive capabilities․ Machine learning algorithms can identify complex patterns in economic data, enhancing forecasting accuracy․ AI-driven models optimize decision-making processes, from policy design to market trend predictions․ The integration of AI in economics fosters innovation, improves resource allocation, and supports data-driven strategies for sustainable growth and risk management․

Educational Resources and Further Reading

Textbooks like Applied Statistics in Business and Economics by Doane and Seward, and online courses on platforms like Coursera, offer comprehensive learning materials․ These resources provide practical insights and hands-on exercises for mastering statistical tools and techniques․

11․1․ Recommended Textbooks on Applied Statistics

Key textbooks include Applied Statistics in Business and Economics by Doane and Seward, offering practical examples and Excel exercises․ Newbold’s Statistics for Business and Economics provides rigorous methodologies, while Carlson and Thorne’s Applied Statistics for Business and Economics focuses on real-world applications․ These texts are enriched with case studies, exercises, and digital resources, making them invaluable for students and professionals seeking to master statistical analysis in business and economic contexts․

11․2․ Online Courses and Tutorials

Online platforms like Coursera and edX offer courses on applied statistics, such as “Business Statistics and Analysis” by the University of Illinois․ These courses provide interactive learning, practical exercises, and certifications․ Tutorials on YouTube and websites like DataCamp teach tools like Excel, R, and Python․ These resources are ideal for professionals and students seeking flexible, self-paced learning to master statistical skills for business and economics․

Applied statistics remains vital in business and economics, driving data-driven decisions and innovation․ Future advancements in technology and methodologies will further enhance its role in shaping industries․

12․1․ The Evolving Role of Statistics in Business and Economics

Statistics in business and economics is evolving rapidly, driven by advancements in technology and data analysis tools․ The integration of big data, AI, and machine learning has enhanced the accuracy of statistical models, enabling better forecasting and decision-making․ As businesses rely more on data-driven insights, the role of applied statistics continues to expand, becoming indispensable for strategic planning and economic growth․

12․2․ Encouraging Lifelong Learning in Applied Statistics

Lifelong learning in applied statistics is crucial as businesses increasingly rely on data-driven decisions․ With evolving tools like R, Python, and Excel, professionals must stay updated․ Textbooks, online courses, and resources like PDFs provide accessible ways to enhance skills․ Encouraging continuous education ensures professionals can adapt to new methodologies and technologies, bridging theory and practice effectively in dynamic business and economic environments․